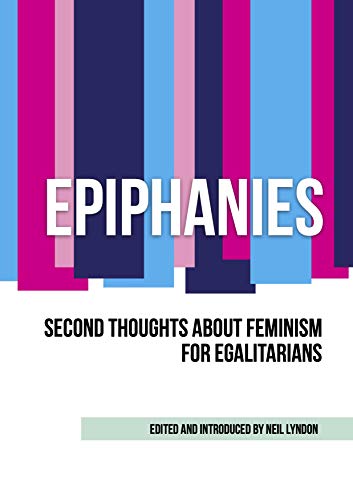

I feel it is my civic duty to warn readers about the obnoxious publication illustrated above. Obviously I’ve not read it, but it will clearly be stuffed with fascist lies. One only has to look at the cast of contributing authors to know what misogynistic nastiness awaits within…

- Neil Lyndon (editor)

- Belinda Brown

- William Collins

- Edward Crabtree

- Warren Farrell

- Janice Fiamengo

- Miles Growth

- Kristal Garcia

- Elizabeth Hobson

- Catherine Kitsis

- Vincent McGovern

- Mallory Millett

- Deepika Narayan

- Natoya Raymond

- Paul Nathanson

- Tony Perry

- David Shackleton

- Karen Straughan

- J. Steven Svoboda

- John Waters

There is no surprise that a man like Lyndon, with his shady history, is associated with this farrago of scurrilous mendacity. But really, the nine women who have chosen to contribute to this vile project should have known better. Clearly there is an epidemic of internalised misogyny going on.

I am confident that my readers will not wish to participate in an exercise calculated to be a danger to women. So, on no account should you click on this link.

I’m told it’s very cheap – cheap trick, more like – do not let that encourage you to buy.

(Also, on no account make any friends, relations or colleagues aware of the book’s existence – thank you).