“I’ll scream and scream ‘til I’m sick!”, quoth Violet Elizabeth, William Brown’s tiny nemesis. It seems that strategy for getting one’s own way is still favoured in some quarters.

Parity’s last News Briefing reported on the failure of the “Back to 6o” campaign’s judicial review. This group of women had sought redress for what they claimed was unfair treatment in the raising of the State Pension Age (SPA) for women from 60 towards equalisation with men. The WASPIs (Women Against State Pension Inequality) are a similar group campaigning for compensation to be given to women born in the 1950s. The exact arguments and objectives of the WASPIs have morphed over time (see Coppola’s The WASPI campaign’s unreasonable demand). The latest incarnation of their claim centres around inadequate warning given to these “1950s women” about the SPA increases.

Despite this claim being emphatically rejected – not only by Government, but also by judicial review – in the current election campaign Jeremy Corbyn has committed to giving the WASPIs what they are asking for, calling it a “moral debt”. Some sources put the cost as high as £58B. The reader may think that this is just another instance of bribing people for votes, I couldn’t possibly comment.

Let us leave aside that men have had a later SPA than women for many decades prior to last year. Let us leave aside that, even with the same SPA, men will typically enjoy fewer years of retirement due to shorter longevity (a life-gap of 3.6 years on average). Let us instead examine whether the specific WASPI claim of inadequate warning about SPA increases is valid, and particular to women.

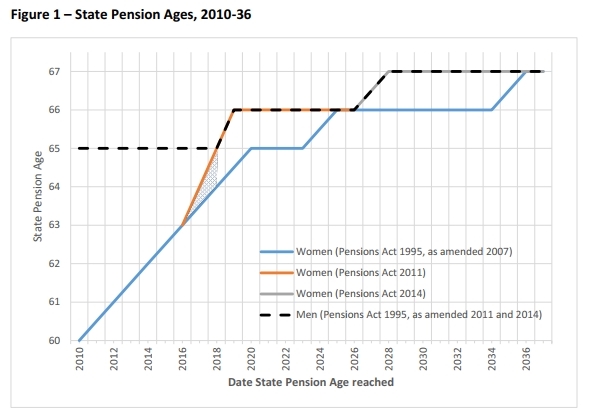

Chapter and verse on the time-line of changes in SPA can be found in House of Commons Briefing Paper CBP-7405 (15 October 2019). This time-line is nicely summarised by Figure 1, taken from Political Quarterly, 88(3), 510-516, WASPI’s is (mostly) a campaign for inequality.

The 1995 Pensions Act was the first to recognise equalisation of the SPA for men and women as the objective, and undertook to raise the SPA for women from 60 to 65 in a phased manner starting in 2010 and completing that process by 2020. Hence women had between 15 and 25 years warning of the intended SPA increase in 1995.

As Brexit is also topical, it is worth noting that this 1995 legislation was, in part, a result of EU pressure. The ruling by the European Court of Justice in 1986 that the UK’s gendered approach to retirement ages was incompatible with the 1976 European Commission’s Equal Treatment Directive required ‘progressive implementation’ of equalisation of pension rights. Ironically, this landmark European Court ruling related to a case brought against HM Government by a woman. She had complained that the Area Health Authority for which she worked required her to retire at the age of 60, despite her desire to go on working. (Just when you thought it was the EU being nice to men, eh? Not at all, just a good illustration that the globalist’s advocacy of “women’s rights” is actually a cover for getting women working more hours).

In 2007 the (Labour) Government first instituted a planned rise in SPA, for both sexes, first to 66 by 2024 and then to 67 by 2036, and then to 68 by 2046.

This was superseded in 2011 by the (Con-Lib Coalition) Government which made two changes to the timetable. It accelerated the final phase of the equilibrating of the SPA for the sexes by accomplishing the increase in women’s SPA from 63 to 65 between 2016 and 2018 rather than between 2016 and 2020, i.e., bringing its completion forward by two years. But the 2011 Pensions Act also brought forward achieving the SPA of 66 from 2024 to 2019. Hence, this change was brought forward by 5 years and was to be implemented in a single year, 2018.

Figure 1 is the clearest depiction of all this.

The women most severely impacted by the 2011 changes are those who turned 64 in 2018 who might have expected to receive their state pension that year, but will now have to wait two more years, receiving their pension at age 66 in 2020 (along with men of the same age). Note that the greatest impact is a two year delay, not five years. These, most impacted women, therefore had 7 years warning that they would not receive their pension in 2018 (the changes having been enacted, recall, in 2011). Is this not reasonable warning?

In any case, men were in a similar position. A man turning 65 in 2018 would have expected to draw his pension that year, but the same 2011 Act meant that he would have to wait another year until he was 66 to do so. Such men also had the very same 7 years warning of this change. This is sufficient to obliterate the WASPI’s claim – unless the same claim of inadequate warning were to be made for men – but the WASPIs are entirely blind to the position of men.

[As it happens, the author of this article is a case in point. I was 65 this year but will not get my state pension until next year. However, there is no WASPI campaign for me, I note – not that I want one].

If the 2011 Act were implemented for men – but the situation for women remained as it was in 2007 under the Labour Government – Figure 1 shows that equalisation of the pension age for the two sexes would have been pushed out to year 2036. This illustrates graphically how fraudulent is the WASPI claim to be based on “equality”. It is actually inspired by “women’s equality”, which surely by now we all know is actually code for preferencing.

Having started by ignoring the starkly obvious state pension inequality which has prevailed for decades prior to last year, namely that to men’s disadvantage, it is perhaps relevant to note that it is men who continue to pump the overwhelming bulk of the monies into the exchequer which pays for pensions, and indeed all public expenditure. The taxation, benefits and pensions systems form a mechanism for the transfer of money from men to women. That is the rather large elephant which goes unnoticed.

This raises another, and more egregious, pension inequality: that between the public and private sectors. The disparity between the two is now quite obscene as the public sector continues to live in a never-never land of unfunded “defined benefit” Ponzi pension schemes, underwritten by the taxpayer. With twice as many women as men in the public sector, this is another aspect of the men-to-women money syphon. But this one is unsustainable, and public sector workers are in for a shock as inevitable as arithmetic.

And finally, all this highlights yet another genuine equality issue: that between the generations. Just as all Government promises, funded by borrowing or taxation, are a burden upon the younger generations, so the WASPI claim is also. I doubt that Corbyn would deliver on his promise, even were he to become PM. But if he did, even the most cursory attention to balancing the books would require passing the bill onto younger people, of both sexes, in the form of further accelerations in SPA increases.